CAXXOR®

CAXXOR GROUP®

BUSINESS MODEL

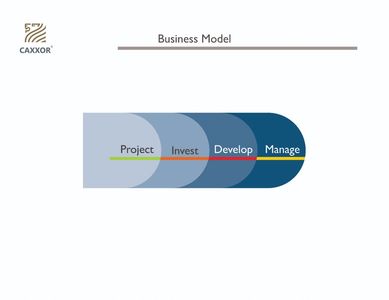

CAXXOR's® business model accompanies the entire cycle of a real asset, including investment. Below we present our scheme, geographies, stages in which we participate as well as the investment categories that we develop.

MODEL

FOUR STAGES

CAXXOR's® business model is based from the development of the project to the management of the asset and the generation of value to evaluate the possible transfer, our capabilities are based on the integration of this model.

WHAT WE DO

PROJECT

INVESTMENT

INVESTMENT

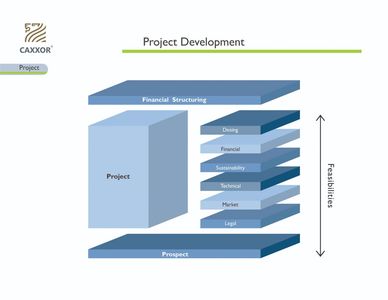

CAXXOR® can develop a project integrating all feasibilities.

INVESTMENT

INVESTMENT

INVESTMENT

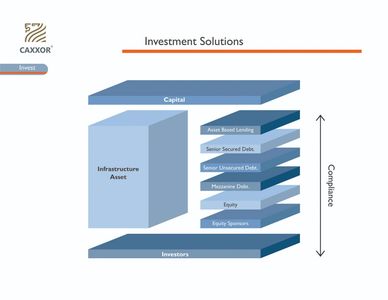

CAXXOR® builds and assembles different investment categories.

DEVELOPMENT

DEVELOPMENT

DEVELOPMENT

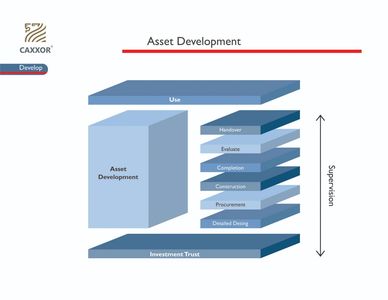

CAXXOR® develops assets until they are delivered in full operation.

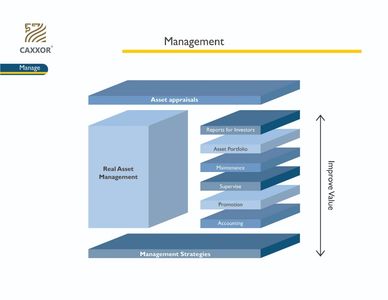

MANAGEMENT

DEVELOPMENT

DEVELOPMENT

CAXXOR® can manage assets while the investment is recovered.

INVESTORS

ACCESS

The investors that we have and that our allies have are mainly of an institutional profile, Our investors are in various regions of the world but are mainly based in North America, Europe and the Middle East and have different risk profiles, we maintain personalized and highly focused relationships with investors, so we never continue to work with more than 10 investors simultaneously.

AMOUNT

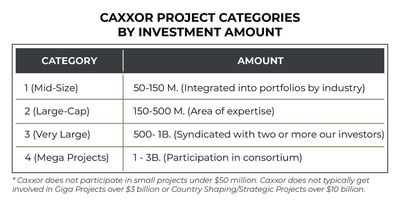

FROM MID-SIZE TO MEGA PROJECTS

From $50 million to $3 billion, CAXXOR® can play different roles in projects in sectors such as infrastructure, natural resources, real estate, commodities and more.

PROCESS AND TIME

PROCESS

PROCESS

PROCESS

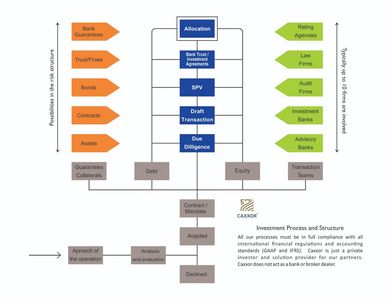

CAXXOR's® main role is to develop and integrate an acceptable risk structure for investors, promote projects and attract equity and debt investors globally, CAXXOR® also coordinates all firms that must get involved to achieve an investment as well as the first tier banks.

TIME

PROCESS

PROCESS

When we have all the elements of information, solvency and disposition in a project, and no legal, technical or financial impediment has been found during the investigation of the project, we can raise investment in 4 months, however times may vary by project (8 months or even 12 months).

Copyright © 2025 CAXXOR® - All rights reserved.